However, if you trade more than 100,000 shares a month, fees decrease gradually. This option is recommended for very high-volume traders.

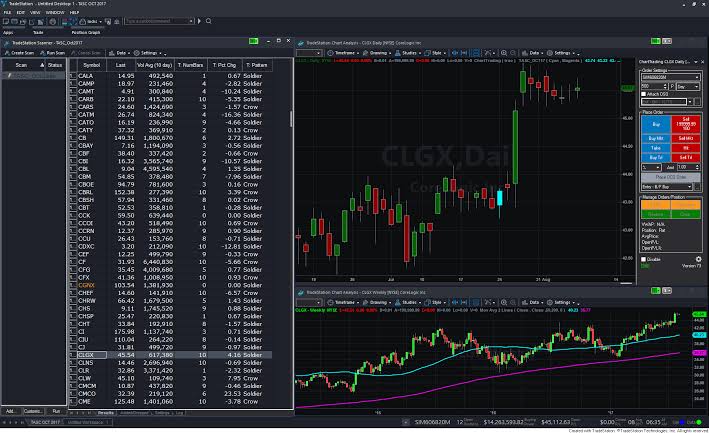

Per trade: all trades cost a fixed $5 per trade.You can select one of three fee packages: To have a clear overview of TradeStation, let's start with the trading fees. See a more detailed rundown of TradeStation alternatives. This selection is based on objective factors such as products offered, client profile, fee structure, etc. We also compared TradeStation's fees with those of two similar brokers we selected, tastyworks and Interactive Brokers. For example, in the case of stock investing the most important fees are commissions. In the sections below, you will find the most relevant fees of TradeStation for each asset class. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.These can be commissions, spreads, financing rates and conversion fees. What you need to keep an eye on are trading fees and non-trading fees. We ranked TradeStation's fee levels as low, average or high based on how they compare to those of all reviewed brokers.įirst, let's go over some basic terms related to broker fees. $50 per year if balance <$2,000 or if less than 5 trades per year

TRADESTATION FREE

Low stock and ETF fees / Free stock trading.On the negative side, withdrawals can be costly. TradeStation has low trading fees, and you can choose from multiple fee structures.

0 kommentar(er)

0 kommentar(er)